new haven house taxes

88 Boston Ave was last sold on Nov 2 2011 for 126000. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

The Town of New Haven.

. Make that in its new sleek two-level home at 197 Dixwell Ave right across the street from its old Dixwell Plaza home in a corner of the new. Office Hours Monday - Friday 900 am. Condo is a 2 bed 10 bath unit.

Learn how New Haven applies its real property taxes with this thorough overview. Box 141 New Haven NY 13121 or try the link above where payments can be made by either credit card or e. 11 hours agoNEW HAVEN The all-new Stetson Library is home.

Also can provide information about property taxes owed and property taxes paid. Please contact your local municipality if you believe there are errors in the data. Single family home located at 3587 Canal Square Dr New Haven IN 46774.

This translates to a median annual property tax payment of 5744 good for second-largest in the state. 1st Floor New Haven CT 06510. 100 York St 16E New Haven CT 06511 is a condo unit listed for-sale at 75000.

Checks should be made payable to the Town of New Haven and dated for the current days date. Property taxes can be paid in person at the Town Office placed in the Drop box or by mail. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Account info last updated on Mar 16 2022 0 Bills - 000 Total. This data is provided for reference only and WITHOUT WARRANTY of any kind expressed or inferred. The cities of New Haven and Waterbury are two of the most populous metropolises in New Haven County.

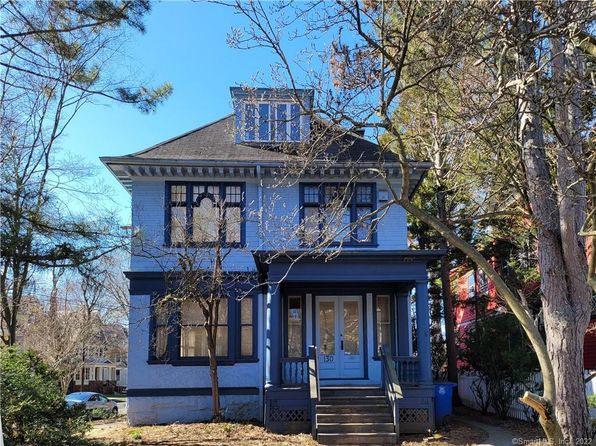

The Town of New Haven is offering alternative options for making Property Tax payments. View more property details sales history and Zestimate data on Zillow. See home details and neighborhood info of this 3 bed 2 bath 1467 sqft.

The Town of New Haven property values on average have risen 247 in the last 10 years from a Total Equalized Value in 2008 of 127582000 to a Total Equalized Value in 2018 of 159190000. The Town Office accepts Cash Check Money Order and Credit Cards. Property Tax Information and Collection Information provided by.

Address 165 Church St. Whether you are already a resident or just considering moving to New Haven to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Assessments Property Taxes.

88 Boston Ave New Haven CT 06512 is a 4 bedroom 2 bathroom 1942 sqft multi-family built in 1900. A mill rate of one mill means that owners of real personal and motor vehicle property are taxed at a rate of 1 on every 1000 of assessed taxable property. 910 State St 6 New Haven CT 06511 359900 MLS 170475473 Rare opportunity to purchase this fabulous East Rock brick townhouse being offered fo.

This is a positive re-affirmation that investing in real estate in these areas is an adequate opportunity for modest growth. City Of New Haven. View Cart Checkout.

United Way of Connecticut The Tax Collector is responsible for collecting local business property and real estate tax payments. If you are already living here only pondering taking up residence in New Haven or interested in investing in its property learn how local property taxes function. The countywide average effective rate is 233.

The mill rate for the 2020 Grand List is 4388. The DMVs Property Tax Section may be reached by by phone at 860 263-5153 or by mail at. Learn all about New Haven real estate tax.

The current Trulia Estimate for 88 Boston Ave is 279300. Personal property and motor vehicle are computed in the same manner. 2 beds 15 baths 1300 sq.

Home Shopping Cart Checkout. DMV Property Tax Unit. The Town is encouraging residents to mail their payments to New Haven Tax Collector PO.

Therefore a property assessed at 10000. BSA Software provides BSA Online as a way for municipalities to display information online and is not responsible for the content or accuracy of the data herein. NEW HAVEN CITY OF - OFFICE OF THE TAX COLLECTOR.

Will pay a tax of 43880. This property is not currently available for sale. Effective property tax rates in New Haven are the highest in the state of Connecticut.

How To Avoid A Tax Bomb When Selling Your Home

What To Do When You Get A Tax Bill For A Home You No Longer Own The Washington Post

How Inheriting A House Works In Canada

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

Michigan Property Tax H R Block

Property Tax How To Calculate Local Considerations

6 Ways To Buy A New Home Before Selling Your Current House

Property Tax Your Mortgage Credit Com

Can You Buy A House If You Owe Taxes Credit Com

How Will Property Taxes Fare In A Surging Housing Market

Countries With No Property Taxes Where You Really Own Your Home

22 Questions To Ask When Buying A House Kin Insurance

Deducting Property Taxes H R Block

All The Taxes You Ll Pay To New York When Buying A Home