does florida have state estate tax

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Social distancing does not have to stop you from attending to your planning needs.

Remember To Update Your Beneficiary Designations Estate Planning Estate Planning Attorney How To Plan

Short-term rentals have their own set of taxes which are normally shifted to the tenant in.

. Either way the State of Florida does not impose any taxes on estates or inheritances but other jurisdictions do. Impose estate taxes and six impose inheritance taxes. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

Florida does not have an inheritance tax also called a death tax. There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. It does however impose a variety of sales and property taxes and some are pretty significant.

Prohibited Under the Constitution. An inheritance tax is a tax on assets that an individual has inherited from someone who has died. Gross Value of FL Property 1 X Federal Credit for State Death Taxes from Form 7062 Florida Estate Tax Gross Value of Entire Estate or 3.

We are equipped to address your estate asset protection and healthcare designation planning with proper precautions in our office or remotely through telephone and video conferencing. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of. Learn more about our services during COVID-19 here or call us at 305-931.

The pro rata portion of the estate tax due Florida is determined by the following formula. Some states have inheritance tax some have estate tax some have both some have none at all. Florida Does Not Have an Estate Tax But The Federal Government Does Fifteen states levy an estate tax.

However you must send federal capital gains tax payments to the IRS. If youve inherited property from someone you wont have to pay the federal estate tax however. Previously federal law allowed a credit for state death taxes on the federal estate tax return.

Does florida have state estate tax. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Does Florida Have Estate Tax.

Floridians no longer need to pay taxes to the state on intangible goods such as investments. The current federal estate tax exemption is 5450000 double for a married couple and is scheduled to increase to 5490000 in 2017 making it applicable to only the very wealthy. The states overall tax burden has nonetheless been ranked among the nations lowest for decades according to the Tax Foundation a non-profit and non-partisan educational.

The state constitution prohibits such a tax though Floridians still have to pay federal income taxes. It also has no inheritance tax or estate tax. Florida does have a property tax on all properties you own and if you are renting or selling that property you may be required to pay federal taxes on any profit made.

An inheritance is not necessarily considered income to the recipient. However federal IRS laws require an estate tax. Other taxes in Florida apply to your earnings and losses.

You must use Schedule D on Form 1040 when calculating and making a payment. The state of Florida does not impose a separate inheritance tax. There is no estate tax in Florida.

In addition the state doesnt. The state abolished its estate tax in 2004. However the personal representative of an estate may still need to complete certain forms to remove the automatic florida.

Florida is one of those states that has neither an inheritance tax nor a state estate tax. Tax paid by the beneficiaries are withheld from the estatetrust. Moreover Florida does not have a state estate tax.

Florida is one of the few states that does not collect income taxes. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax. See where your state shows up on the board.

Florida doesnt have a personal income tax nor does it have an estate tax or an inheritance tax. The good news is Florida does not have a separate state inheritance tax. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

This lack of inheritance tax combined with the absence of Florida income tax makes Florida attractive for. Florida isnt unique in this regard only fourteen states have an estate tax and four more have an inheritance tax New Jersey and Maryland have both. No portion of what is willed to an individual goes to the state.

An estate tax is a tax on a deceased persons assets after death. Florida one of our 10 most tax-friendly states for retirees has no state income tax. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as.

Real estate transactions are subject to federal and state taxes as well such as the capital gains tax mentioned above. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Florida does not collect an estate tax.

That means no state taxes on Social Security benefits pensions IRAs 401ks and other retirement income. Twelve states and Washington DC. If a nonresident decedent owned Florida property a pro rata portion of the credit for state death taxes see Part II Florida Form F-706 is due to Florida.

However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax. A federal change eliminated Floridas estate tax after December 31 2004. These are all costs that are important to consider and understand before buying or selling a home in Florida.

The good news is Florida does not have a separate state inheritance tax. But if you transfer an estate valued at something higher than that upon death the federal government can tax a portion of the estate you leave behind before its transferred to the designated heirs. Luckily there is no Florida estate tax.

But Florida does stand out in that estate taxes are expressly. However its state and local tax burden of 89 percent ranks it 34th nationally. It only applies to estates worth a certain amount which varies based on which municipality is levying the tax.

Florida also does not assess an estate tax or an inheritance tax. Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. Unless the estate or trust has a value exceeding 12060000 million 2022 the federal estate tax only applies to trusts or estates.

Accordingly Is there a probate tax in Florida. Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. If you have to pay capital gains taxes those will be due at filing.

Maryland is the only state to impose both. You may have heard the term death tax but estate tax is the. Florida is one of a few states that does not have state income tax making the state a popular place to retire.

Filing and paying Florida capital gains tax isnt necessary since Florida doesnt have state-specific rules. As noted above the federal estate tax rate can climb to 40 depending on the size of your taxable estate. What Is the Estate Tax.

The federal government then changed the credit to a deduction for state estate taxes. Estate taxes are levied by the government on the estate of a recently deceased person.

I Moved Out Of California In Retirement But It Wasn T Because Of Taxes Marketwatch Retirement Tax Moving To Another State

State By State Guide To Taxes On Retirees Most Tax Friendly Dark Green Tax Friendly Lime Green Mixed White Not Tax Retirement Tax Retirement Income

Florida Inheritance Tax Beginner S Guide Alper Law

Monday Map State Local Property Tax Collections Per Capita Teaching Government Property Tax Map

State By State Guide To Taxes On Retirees Retirement Advice Retirement Locations Retirement

Daniel Sasse Realtor Associate Listing Agent Keyes Co Boca Ft Lauderdale Miami Why Are People Migrating To Fl In 2022 Inheritance Tax People Real Estate

Here Are Four Big Benefits To Being A Florida Resident 1 No State Income Tax Florida Is One Of Only Seven States With No Income T Florida Income Tax Resident

Florida Property Tax H R Block

Florida Inheritance Tax Beginner S Guide Alper Law

2021 How Florida Compares Taxes

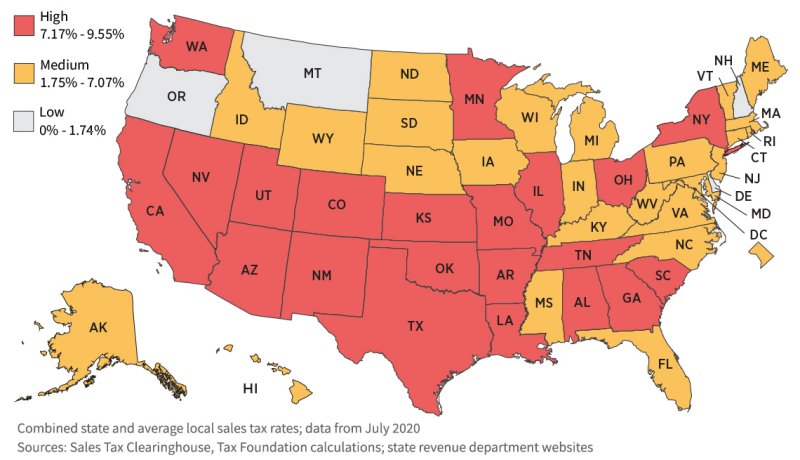

States With Highest And Lowest Sales Tax Rates

How Bill Gates And Warren Buffett Estates Will Pay Zero Estate Tax Https Youtu Be Euj0ncxvmpq Estate Tax Estate Planning Checklist Warren Buffett

579 Real Estate Tax Appraisal Districts Reiclub Realestateinvesting Estate Tax Appraisal Investing

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income Best Places To Retire Retirement Locations

The Best And Worst U S States For Retirement Retirement Best Places To Retire Life Map

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel

State Corporate Income Tax Rates And Brackets Tax Foundation

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons